Built for complex,

siloed banking data

Connect and unify data from across your entire product ecosystem, no matter how fragmented.

BANKING

Banks are facing new challenges and new expectations. To stay competitive, they must deliver faster, more personalised experiences across every channel. But doing that with legacy infrastructure often requires years of data engineering and development.

Solitics changes the equation. Turning the data you already have into targeted, real-time customer engagement.

Customer expectations haven’t just changed – they’ve been reset by digital banks and brokerage platforms already delivering real-time, personalised engagement at scale.

Traditional banks still have the advantage: Trust, scale and deep customer data. But to stay ahead, they need to engage smarter and faster than ever before.

Connect and unify data from across your entire product ecosystem, no matter how fragmented.

Trigger contextual journeys the moment a customer acts. No delays, no batching and minimal manual work.

Certified for GDPR, ISO/IEC 27001:2013 and SOC 2. Designed to meet strict regulatory standards.

Connects to your current infrastructure without interrupting core operations.

Delivers real-time engagement at enterprise scale. Thousands of triggers per second and zero performance lag.

Solitics’ integration takes less than a month on average, with a 45-day delivery guarantee.

Challenge

ONE ZERO was scaling fast, but its marketing tools couldn’t keep up.

Campaigns were limited, journeys weren’t automated and every new

customer touchpoint required manual work from technical teams.

To grow efficiently, they needed to:

Solution

ONE ZERO chose Solitics for its ability to handle complex data and

automate real-time engagement. The platform empowered their

marketing team to launch journeys independently, personalise at

scale and go live within weeks – including seamless integration with

their investment insights tool. All without any disruption to their

systems.

Results

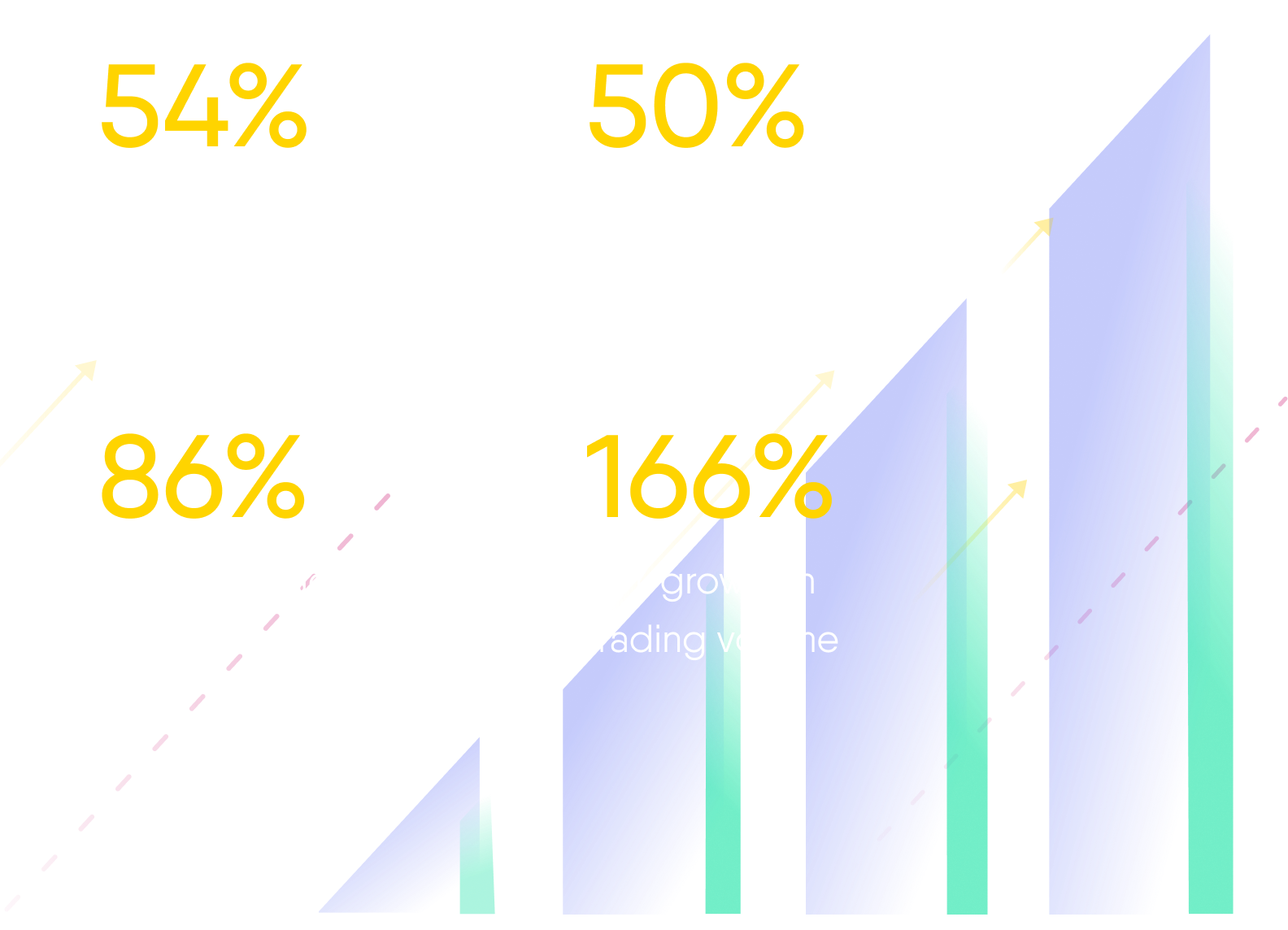

ONE ZERO quickly scaled its marketing operations and saw measurable

results across the board:

Solitics’ advanced capabilities empowered us to dramatically improve our operational efficiency and the scope of our marketing initiatives. We are now able to achieve more with ease and fewer people involved.

Every login, transaction or product milestone is an opportunity to engage your customers. Solitics instantly translates these moments into personalised messaging across all channels, including email, SMS, in-app and push notifications.

By leveraging customer context like product usage, lifecycle stage and past activity, banks can meaningfully engage customers exactly when it matters most. This real-time responsiveness drives deeper relationships and tangible growth, directly enhancing profitability.

Most banks still see accounts, not people. Customers expect personalized experiences, but fragmented data makes that hard to deliver.

Solitics offers a better way: One unified customer profile, built across every banking product – from our proven trading solution to lending and savings.

Do you have a customer who holds a mortgage but no credit card? Trigger a personalised offer, automatically. Multiple accounts under one user? No problem. Solitics turns scattered data into clear, actionable insight.

Solitics removes compliance as an obstacle by meeting rigorous standards such as GDPR, ISO/IEC 27001:2013, and SOC 2, enabling your bank to confidently engage customers in real time without regulatory friction.

Transparent, auditable logs track every action and change made within the platform, ensuring accountability.

Define precisely who sees and manages sensitive data, reducing risks and strengthening internal controls.

Support for zero-PII environments and automated filtering of sensitive data ensures customer privacy at every step.

Data is encrypted at rest and in transit, safeguarding sensitive information across your entire engagement pipeline.

Data policies are applied continuously, preventing compliance breaches before they occur.

For many banks, complexity isn’t just a tech challenge – it’s a barrier to growth. Legacy infrastructure, manual execution and long integration cycles make launching new campaigns slow and costly.

Our platform connects directly to your existing tech stack. In just 45 days, you are guaranteed a fully operational, real-time engagement engine that works with what you already have.

All your channels, data and automation tools – working together and managed from a single, unified UI. Finally. Personalised customer engagement that’s as seamless as it is powerful.

With Solitics, banks can act on the data they already have. Trigger journeys based on account activity, financial milestones, rate changes or periods of inactivity. Instantly, across every channel.

With Market Pulse, engagement goes even further. Connect live market data to deliver timely, relevant messages the moment sectors move, trends shift or investment opportunities arise.

What used to require dedicated teams and manual effort can now happen automatically. Deliver the level of personal attention once reserved for premium clients. At scale, in real time and without the operational overhead.

We understand the immense volume and complexity of data generated by banks. Every login, transfer, product interaction and regulatory event adds to the load. Solitics is built to handle it all.

Our platform processes thousands of triggers per second, across millions of users, with zero performance lag. No shortcuts. No batching. Just real-time responsiveness you can rely on. Even in the most demanding environments.

Enterprise-grade performance, built in.

Reach Out and Learn How Solitics Can Support Your Growth

6B+

Automated personalised messages100M+

Engaged users in full automation500M+

Daily events86%

Increase in user retention MoM40%

Growth in user75%

Growth in conversionGet more info on Solitics’ solution, product and pricing

Get a live demo

Request pricing

Platform tour

Can Solitics work with our legacy infrastructure and data systems?

Yes. Solitics is designed to integrate seamlessly with complex, distributed data environments — including legacy systems. No need for system overhauls or long implementation cycles. In just 45 days, you’ll have a real-time engagement engine running on top of your existing stack, using the data you already have.

What kind of data does Solitics use to power campaigns?

Solitics connects to your CRM, platform, frontend, third-party APIs and more – in real time. Every campaign runs on live behavioural, transactional and contextual data. Automatically.

What channels are supported for customer engagement?

Solitics gives you full flexibility to engage customers on any channel with hyper-personalised messages that respond to real-time data.

Dynamically insert customer attributes – like balance, tenure or product usage – into any message, across:

Every message. Every format. Fully personalised, fully automated.

How does Solitics handle multi-account and multi-brand setups?

Solitics natively supports customers with multiple accounts, across multiple brands or platforms. That means you can engage a single user based on their total activity, not just what happens in one account. All data is unified at the user level for consistent, relevant engagement.

Is Solitics compliant with banking regulations?

Yes. Solitics is fully GDPR-compliant and designed to support the data privacy, security and operational transparency required by regulated brokers and financial platforms. From consent management to audit logs and role-based access, everything is built for compliance. Without compromising performance.

How fast is implementation?

Most brands are up and running with Solitics within a month. The integration is fast, flexible and doesn’t require IT or development work from your side. Our team handles it all. And with our 45-day implementation guarantee, you get full confidence we’ll deliver on time.